Outsourced Ion Channel Testing Trends

Complete the form below to unlock access to ALL audio articles.

Introduction

Ion channels play a key role in regulating electrical activity in excitable cells, and many additional roles in non-excitable tissues. They are important therapeutic targets in a range of indications including arrhythmia, hypertension, local anaesthesia, pain, stroke, epilepsy, depression, bipolar disorder, COPD, autoimmune disorders and diabetes. Not only are ion channels major drug targets, but they are also important indicators for drug safety. Indeed, many drugs withdrawn from the market due to cardiac related adverse effects have been shown to block the human ether-a-go-go (hERG) ion channel, which delays repolarization of the cardiac action potential and can result in a potentially fatal arrhythmia known as Torsades de Pointes (TdP).

Performing high throughput screening (HTS) or lead optimization against a target of interest, identification of a compound’s target specificity by selectivity profiling, and checking for safety liabilities/risk assessment are all critical steps in the drug discovery process. Ion channel testing has evolved considerably in recent years with third generation automated patch clamping (APC) platforms addressing both voltage and ligand-gated channels at high throughput (HT) and at higher seal resistances. These newer HT APC platforms have allowed fee-for-service providers the possibility to offer cost-effective high quality outsourced ion channel primary screening and selectivity profiling for drug discovery, this is in addition to fluorescent-based assays and lower throughput conventional (manual patch) electrophysiology.

Read: automated patch-clamping trends

Most service providers that offer selectivity profiling have a large collection of stably transfected ion channel cell lines from which they assemble channel panels. Many service providers have also adapted and validated these cell lines for use on HT APC systems, some also sell their cell lines commercially. Providers of outsourced ion channel testing fall into 2 categories: 1) specialty CROs (i.e. providers with offerings limited to ion channel screening or ADME or animal models or clinical studies or any combination of these activities, but NOT the entire value chain); and 2) single-source or integrated CRO (i.e. a one-stop shop offering all activities).

In July 2016, HTStec undertook a market survey on outsourced ion channel testing mainly among research labs in pharma, biotech and academia. The survey was initiated by HTStec as part of its tracking of life science marketplaces and to update their previous outsourced ion channel testing trends report (published May 2013). The main objectives were to comprehensively document current use of and potential interest in outsourcing ion channel primary screening, selectivity profiling and safety liability testing. The survey also investigated access to stably transfected cell lines and future purchasing plans. The aim was to compile a reference document on outsourced ion channel testing, which could be directly compared with HTStec’s previous 2013 report. This article contains selected findings from the HTStec market report, ‘Outsourced Ion Channel Testing Trends 2016’.

It is intended to provide the reader with a brief insight into recent market trends. It covers only 11 out of the 32 original questions detailed in the full report. The full published report should be consulted to view the entire dataset, details of the breakdown of the responses for each question, its segmentation and the estimates for the future.

Outsourced primary screening of ion channels

Only a minority (32%) of survey respondents have outsourced the primary screening of ion channels to date and 18% of survey respondents had no foreseeable interest in outsourcing primary screening over the coming years. Where interested, the platforms for the primary screening of ion channels survey respondents most want to outsource to fee-for-service providers are given in Figure 1. This showed that automated patch-clamp (APC) was the most wanted platform (46%). This was followed by fluorescence-based assays (e.g. FLIPR/Hamamatsu FDSS) (19%), manual patch clamp (16%), multi-electrode array assays (MEA) (12%), and then membrane binding assays (6%). In contrast, the most used platform for primary screening of ion channels undertaken in- house is fluorescence-based assays. Figure 1. Ion Channel Primary Screening Platform Respondents Want To Outsource At A Fee-For-Service Provider.

Figure 1. Ion Channel Primary Screening Platform Respondents Want To Outsource At A Fee-For-Service Provider.

Outsourced selectivity profiling of ion channels

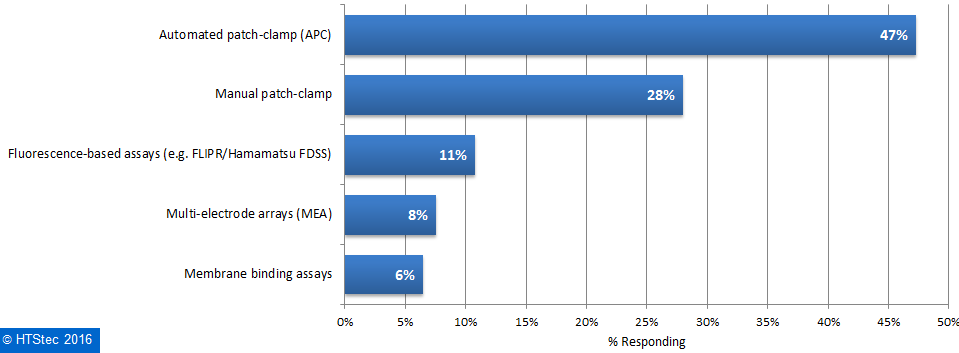

Most (61%) survey respondents outsourced selectivity profiling of ion channels in 2016 and only a minority (9%) of survey respondents do not anticipate outsourcing over the coming years. The platforms for selectivity profiling of ion channels survey respondents most want to outsource to fee-for-service providers are presented in Figure 2. This showed that the preferred platform for selectivity profiling of ion channels to be accessed at service providers was automated patch-clamp (APC) (47%). This was followed by: manual patch clamp (28%); fluorescence-based assays (e.g. FLIPR/Hamamatsu FDSS) (11%); multi-electrode array assays (MEA) (8%); and membrane binding assays (6%). Figure 2. Ion Channel Selectivity Profiling Platform Respondents Want To Use/Access At A Fee-For-Service Provider.

Figure 2. Ion Channel Selectivity Profiling Platform Respondents Want To Use/Access At A Fee-For-Service Provider.

The stage in the drug discovery process where survey respondents most want outsourced selectivity profiling is shown in Figure 3. This showed that most (24%) respondents want to outsource selectivity profiling after hits-to-leads (lead optimization). This was followed by either: after secondary/counter screening or after primary screening/HTS (both 15%); ‘after some initial selectivity profiling results generated in- house’ (14%); ‘no fixed stage, we want to profile lead compounds from other therapeutic areas’ (12%); and then, ‘when about to start IND enabling’ (3%).  Figure 3. When Respondent's Want To Outsource Selectivity Profiling.

Figure 3. When Respondent's Want To Outsource Selectivity Profiling.

The preferred way of selecting particular assays for outsourced ion channel selectivity profiling are given in Figure 4. This showed that respondents ranked selection by target as their most preferred way of choosing assays when deciding on ion channel selectivity profiling. This was followed by selection by family, selection by testing platform, and then selection by therapeutic area.  Figure 4. Preferred Way Of Selecting Assays For Ion Channel Selectivity Profiling.

Figure 4. Preferred Way Of Selecting Assays For Ion Channel Selectivity Profiling.

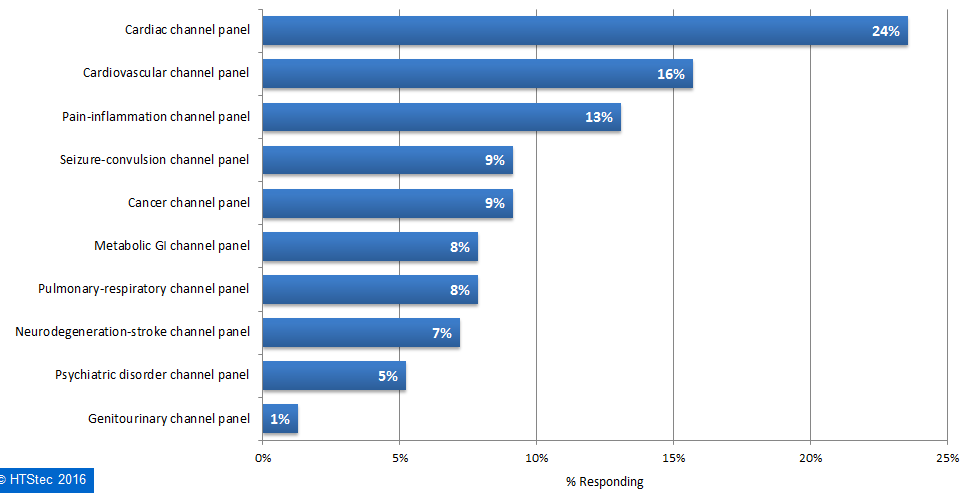

The ion channel panels of most interest when considering outsourced selectivity profiling are presented in Figure 5. This showed that a cardiac channel panel was most wanted for selectivity profiling (26%). This was followed by a cardiovascular channel panel (16%), and then a pain-inflammation channel panel (13%). All others panel had less than 10% interest.

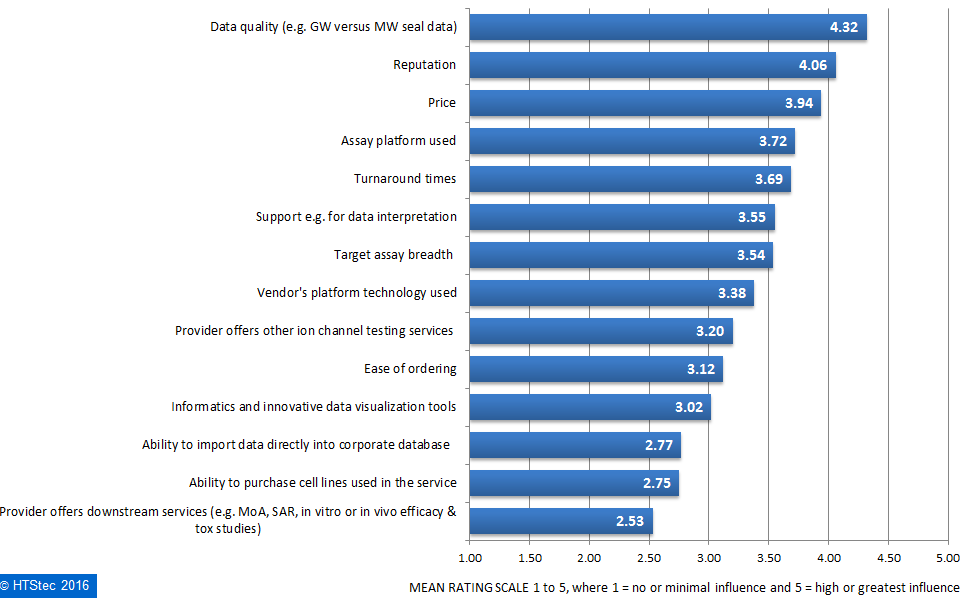

What motivates the selection of a fee-for-service ion channel selectivity profiling provider is detailed in Figure 6. This showed that survey respondents rated data quality (e.g. Giga ohm versus Mega ohm seal data) as the greatest motivation in selecting an ion channel selectivity profiling provider. This was very closely followed by price, assay platform used and then turnaround times. Rated as of least influence, was ‘provider offers downstream services’.

Figure 6. What Motivates Selection Of An Ion Channel Selectivity Profiling Provider.

Figure 6. What Motivates Selection Of An Ion Channel Selectivity Profiling Provider.Outsourced ion channel safety liability testing

The aspect of ion channel safety liability testing survey respondents most want to outsource today are given in Figure 7. This showed that cardiac ion channel panel assays - automated patch clamp; hERG IC50 assay - non-GLP; and hERG ion channel assays were the most wanted assays (all with 41%). They were followed by hERG IC50 assay – GLP (30%); and then cardiac ion channel panel assays - manual patch clamp and hERG screening assay (both 25%). Least wanted were stem cell-derived human cardiomyocytes assays (field potential, MEA, impedance, IcaICa, L activator assay).

Figure 7. Aspects Of Ion Channel Safety Liability Testing Outsourced.

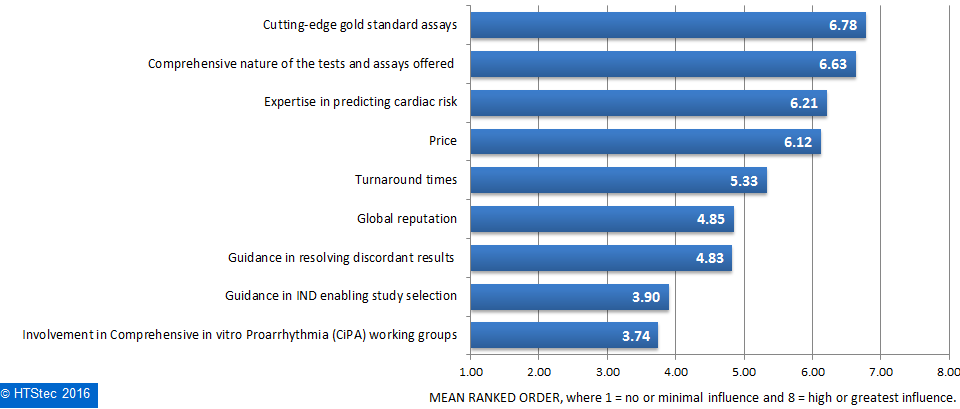

Figure 7. Aspects Of Ion Channel Safety Liability Testing Outsourced.What motivates end-user selection of an ion channel safety liability provider is reported in Figure 8. This showed that ‘cutting-edge gold standard assays’ were ranked as what most motivates their selection of an ion channel safety liability provider. This is very closely followed by ‘comprehensive nature of the tests and assays offered’, and then ‘expertise in predicting cardiac risk’ and ‘price’. Ranked as least influential was ‘Involvement in comprehensive in vitro proarrhythmia (CiPA) working groups’.

Figure 8. What Motivates Selection Of An Ion Channel Safety Liability Provider.

Figure 8. What Motivates Selection Of An Ion Channel Safety Liability Provider.Spending on ion channel testing services

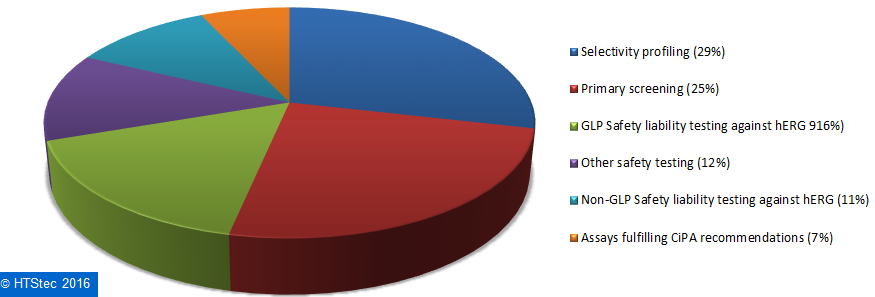

How survey respondents spend on outsourced ion channel testing services is broken down and presented in Figure 9. This showed that the biggest proportion (29%) of survey respondents’ 2016 outsourced ion channel testing budget was spent on selectivity profiling, this was followed by primary screening (25%); GLP Safety liability testing against hERG (16%); other safety testing (12%); non-GLP Safety liability testing against hERG (11%); and then assays fulfilling CiPA recommendations (7%).

Figure 9. Breakdown Of Current (2016) Outsourced Ion Channel Testing Budget.

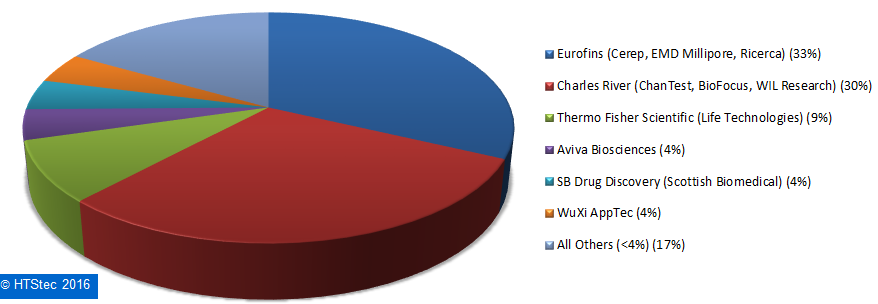

Figure 9. Breakdown Of Current (2016) Outsourced Ion Channel Testing Budget.The most used fee-for-service providers of ion channel testing services are reported in Figure 10. This showed that Eurofins (33%) was the most used fee-for-service provider of ion channel testing. It was very closely followed by Charles River (30%) and then more distantly by Thermo Fisher Scientific (9%), Aviva Biosciences (4%), SB Drug Discover (4%)y and Wuxi Pharmatech (4%). All other providers (totaling 17%) each had less than 4% share of use. This provider selection should not be confused as a true market share, it is not based on the actual $ value of services purchased, but on which provider survey respondents indicated they have most used over the past 12 months.

Figure 10. Most Used Fee-For-Service Providers Of Ion Channel Testing Services.

Figure 10. Most Used Fee-For-Service Providers Of Ion Channel Testing Services.The importance (influence on provider selection) of an ion channel testing fee-for-service provider offering specific services is detailed in Figure 11. This showed the survey respondents rated most highly ‘access to selectivity profiling (ion channels only)’ as the offering an ion channel service provider must provide to be worthy of consideration. This was followed by selectivity profiling (ion channels, GPCRs & kinases); and then assays fulfilling CiPA recommendations and GLP safety liability testing. Rated least wanted (not needed) was med chem around lead series (Figure 10).

Conclusions

The selected findings reported above showed that automated patch-clamping was the technology platform most want to access at fee-for-service providers for both primary screening and selectivity profiling of ion channels. Interest in outsourcing selectivity profiling was greater than that for primary screening. The preferred stage in the drug discovery process to access outsource selectivity profiling was after hits-to-leads (lead optimization). Selection by target was the most preferred way of choosing assays when deciding on ion channel selectivity profiling, with a cardiac channel panel being the most wanted ion channel panel for selectivity profiling. Data quality (e.g. Gohm versus Mohm seal data) was rated as the greatest motivation in selecting an ion channel selectivity profiling provider. Cardiac panel automated patch clamp assays, non-GLP hERG IC50 assays and hERG ion channel assays were the aspects of ion channel safety liability testing survey respondents most want to outsource today. Availability of cutting-edge gold standard assays was ranked as ‘what most motivates the selection of an ion channel safety liability provider’. The biggest proportion of outsourced ion channel testing budgets in 2016 was spent on selectivity profiling, with Eurofins and Charles River being the most used fee-for-service providers of ion channel testing. The availability of an extensive validated ion channel selectivity profiling offering based on a range of assay platforms was what most influenced the selection of an ion channel testing fee-for-service provider.

Overall the use of outsourced ion channels testing services, particularly for selectivity profiling, is the preferred option for many drug discovery groups. However, the implementation of the CiPA initiative is expected to change the focus in nonclinical cardiac safety assessment by replacing the early hERG assessment (non-GLP) with an evaluation of compounds against multiple cardiac currents (APC); in silico modeling of cardiac action potentials; and the use of stem cell-derived human cardiomyocyte assays (e.g. MEA), as a multicellular test system that recapitulates the physiological properties of the human heart (e.g. with ECG-like field potentials). CiPA does however not displace GLP hERG or GLP in vivo ECG in a large animal which will still be needed for IND enabling, and are key services available at CROs. It will be interesting to see how outsourced providers of in channel testing services adapt to the changing regulatory requirements and the emergence of new in vitro screening technologies and approaches over the coming years.

DISCLAIMER: HTStec Limited has exercised due care in compiling and preparing these Selected Findings from its Report, which is based on information submitted by individuals in respondent companies. HTStec Limited has NOT verified the accuracy of this information, nor has it established respondent’s authority to disclose information to HTStec Limited. HTStec Limited expressly disclaims any and all warranties concerning these Selected Findings including any warranties of merchantability and/or fitness for any particular purpose, and warranties of performance, and any warranty that might otherwise arise from course of dealing or usage of trade. No warranty is either expressed or implied with respect to the use of these Selected Findings. Under no circumstances shall HTStec Limited be liable for incidental, special, indirect, direct or consequential damages or loss of profits, interruption of business, or related expenses that may arise from the use of these Selected Findings, including but not limited to those resulting from inaccuracy of the data therein.